How Ach Processing can Save You Time, Stress, and Money.

Table of ContentsNot known Details About Ach Processing The 3-Minute Rule for Ach ProcessingA Biased View of Ach ProcessingHow Ach Processing can Save You Time, Stress, and Money.Everything about Ach ProcessingGet This Report on Ach Processing

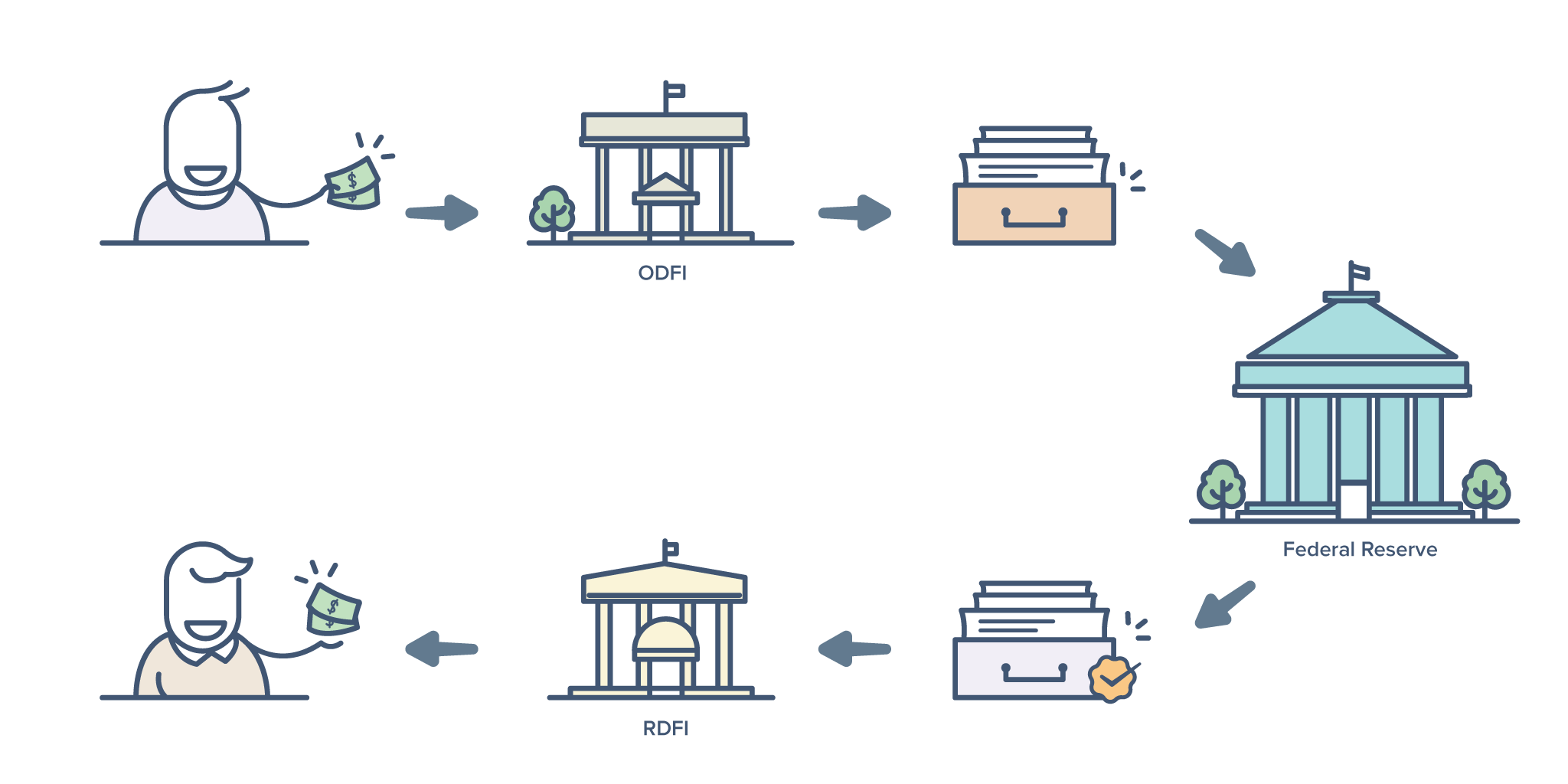

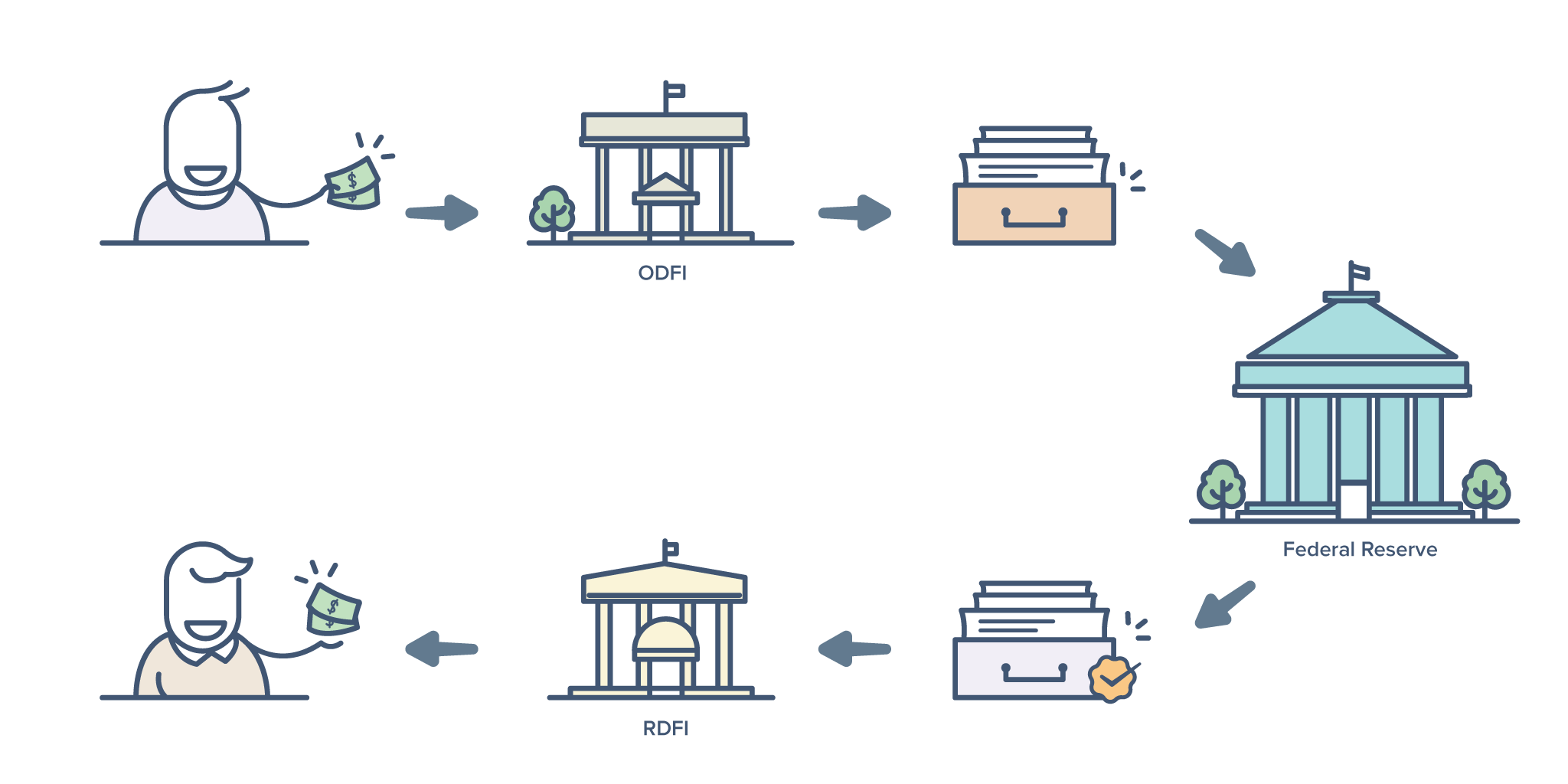

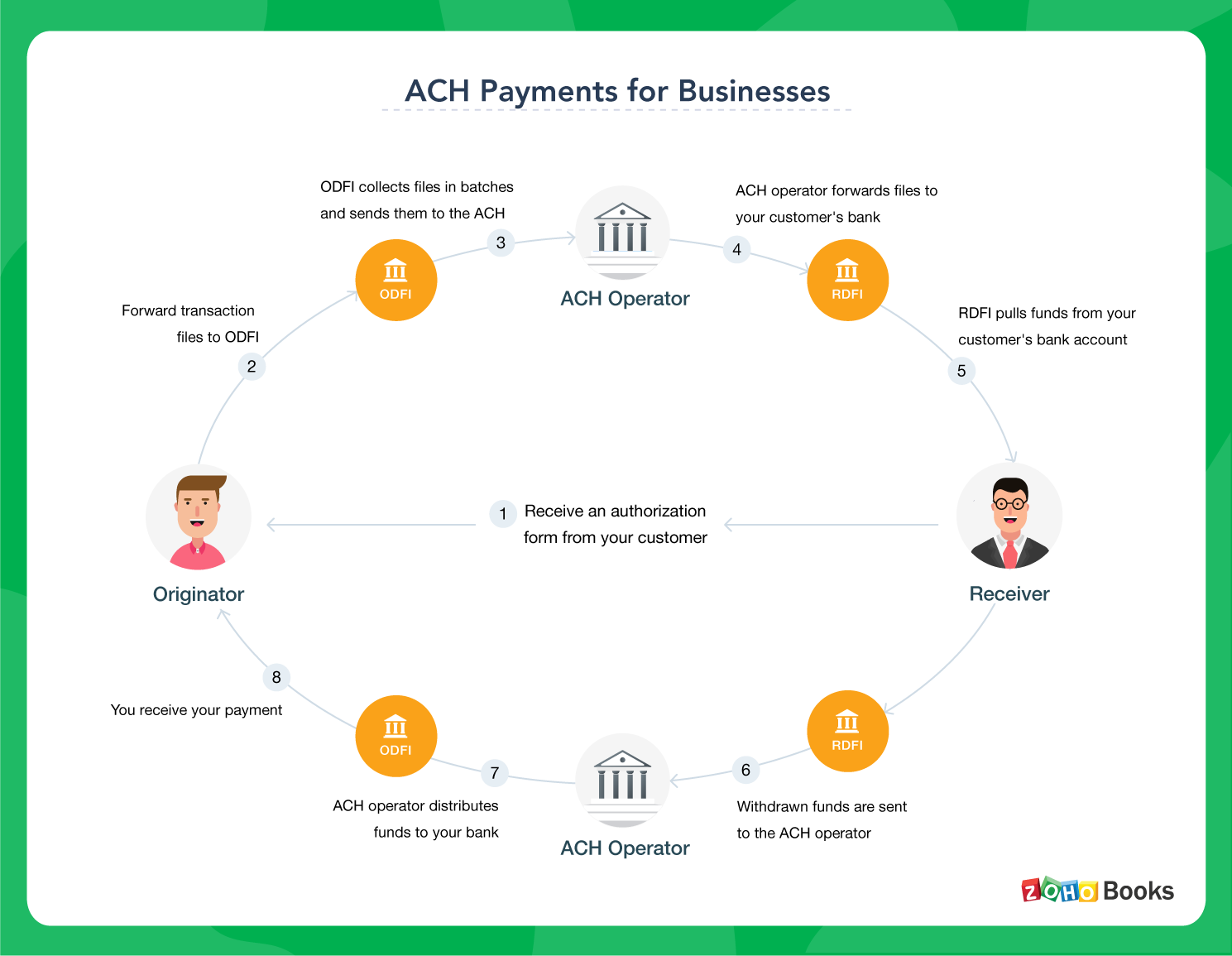

The Federal Book after that sorts all the ACH documents and after that directs it to the receiver's financial institution the RDFI.The RDFI then refines the ACH files as well as credit scores the receiver's (Hyde) account with 100$. The instance above is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the very same process takes place backwards.The RDFI posts the return ACH file to the ACH network, along with a reason code for the error. ACH repayments can offer as a wonderful option for Saa, S companies.

With ACH, considering that the purchase handling is reoccuring and also automated, you would not need to wait for a paper check to arrive. Also, because clients have licensed you to gather repayments on their behalf, the versatility of it enables you to gather one-time repayments as well. No much more awkward emails asking consumers to compensate.

Get This Report about Ach Processing

Credit report card repayments fall short because of various factors such as ended cards, obstructed cards, transactional errors, and so on - ach processing. Often the customer can have surpassed the credit line as well as that can have caused a decline. In situation of a bank transfer through ACH, the financial institution account number is utilized in addition to a permission, to bill the client and also unlike card transactions, the likelihood of a bank transfer stopping working is really low.

Unlike card purchases, financial institution transfers stop working only for a handful of factors such as inadequate funds, wrong financial institution account info, etc. The two-level confirmation procedure for ACH payments, ensures that you keep a touchpoint with clients.

The customer initially increases a demand to pay by means of ACH and afterwards, after confirming the customer, ACH as a repayment option is allowed for the particular account. Just then, can a customer make a straight debit payment by means of ACH. This verification consists of inspecting the validity as well as legitimacy of the checking account.

How Ach Processing can Save You Time, Stress, and Money.

This protected process makes ACH a trustworthy option. If you're considering ACH, head below to know just how to accept ACH debit settlements as an on-line company. For each and every charge card transaction, a portion of the money included is divided across the different entities which made it possible for the payment. A major piece of this charge is the Interchange find out here now cost.

In situation of a deal routed by means of the ACH network, given that it straight deals with look at here the banking network, the interchange cost is around 0. 5-1 % of the overall transaction.

Not known Incorrect Statements About Ach Processing

They charge high volume (more than $1000) individuals with only $30 flat charge for unrestricted ACH deals. You can drive raised fostering of ACH settlements over the lengthy term by incentivizing customers making use of incentives and also rewards.

ACH transfers are digital, bank-to-bank cash transfers refined via the Automated Clearing Up Residence (ACH) Network. According to Nacha, the organization in charge of these transfers, the ACH network is a set processing system that banks and other financial institutions usage to accumulation these deals for processing. ACH transfers are electronic, bank-to-bank money transfers processed via the Automated Clearing Up Home Network.

Indicators on Ach Processing You Should Know

Direct payments entail money going out of an account, consisting of expense payments or when you send money to somebody else. ACH transfers are convenient, fast, as well as typically totally free. ach processing. You might be limited in the variety of ACH deals you can initiate, you might incur additional fees, and also there may be hold-ups in sending/receiving funds.

Getting your pay via direct down payment or paying your bills online via your savings account are simply two instances of ACH transfers. You can also utilize ACH transfers to make single or persisting deposits into an specific retirement account (INDIVIDUAL RETIREMENT ACCOUNT), a taxable brokerage firm account, or a university interest-bearing account. Local business owner can additionally use ACH to pay suppliers or receive repayments from customers and consumers.

Nacha reported that there were 29 billion payments in 2021. That's a boost of 8. 7% from the previous year. Person-to-person and also business-to-business transactions likewise raised to 271 million (+24. 9%) and 5. 3 billion (+21%), respectively, for the very same duration. ACH transfers have numerous usages and also can be more cost-effective and also user-friendly than composing checks or paying with a credit scores or debit card.

The 9-Second Trick For Ach Processing

ACH transfers can make life simpler for both the sender and recipient., or when you had to stroll your costs repayment down to the electric firm prior to the due date.